34+ Mortgage calculator including fees

525 oryour current interest rate plus 2. In many countries 25-year mortgages are structured as adjustable or variable rate loans which reset annually after a 2 3 5 or 10 year introductory period with a teaser rate.

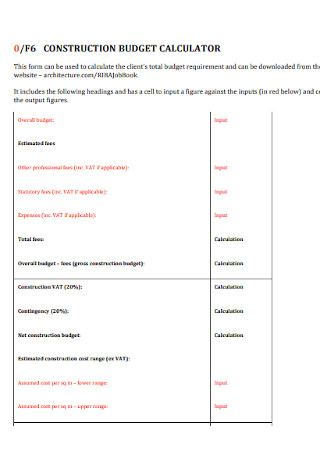

34 Sample Budget Calculators In Pdf Ms Word

Estimating monthly mortgage payments is an excellent way of getting a sense of your buying power and what you could potentially afford with a USDA loan.

. You can use the above calculator to generate a sample amortization schedule. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. The Bank of Canada five-year benchmark rate of.

Use SmartAssets free Florida mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. A cap of 225 means the loan can change up to 2 on any adjustment up to a lifetime adjustment of 5 above the initial rate of interest.

Loans can use the same number or different numbers for the initial adjustment periodic reset. Todays national mortgage rate trends. The mortgage amortization.

By rolling the fees into the loan you pay an extra 3485 in interest over the first 2 years. The annual cost of credit reflecting all costs including points origination fees mortgage insurance. The amount depends on the community in which you live but the fees can be 100 to 200 per month.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. How the USDA Loan Calculator Works. You can pay for arrangement fees upfront or finance it into your mortgage.

The Product selection menu lets you compare different loan terms like 15 or 30 year fixed rate options other lending options like 31 51 71 ARMs or even IO. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Our home loan calculator accounts for all the essential conditions that will affect mortgage costs including loan type loan amount down payment interest rate and more.

Get 247 customer support help when you place a homework help service order with us. Meanwhile for a 30-year FRM there are 360 payments spread across 30 years. We add the total fees per month to your monthly mortgage payment and multiply by 12 to calculate.

Other loan adjustment options including price down payment home location credit score term ARM options are available for selection in the filters area at the top of the table. Our mortgage comparison tool shows you the best mortgage rates in the UK including exclusive deals. See how your monthly payment changes by making updates to.

On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The mortgage repayment calculator is a great way to start but its certainly not a definitive answer and if its not the answer youre looking for our experts can review your full situation and advise on the most appropriate course of action including products you might not previously have considered.

Thus its better to pay the arrangement fee upfront. Across the United States 88 of home buyers finance their purchases with a mortgage. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other.

Your household income location filing status and number of personal exemptions. Click here to see our full line of mortgage calculator embed. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

The other category including further advances comprised 460 of new commitments. Looking at new commitments 7181 were for home purchases while 2359 were for remortgages. Booking fees To secure your new deal you might be charged a booking fee.

The Bank of Canada five-year benchmark rate of. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. All-items Consumer Price Index CPI Basket Content Canada 10000. The most common home loan term in the US is the 30-year fixed rate mortgage.

Included in the calculator are features unique to the USDA loan including the USDAs upfront mortgage insurance and annual fees. Use our mortgage calculator to find out how much you might be able to afford to borrow. The calculator only provides preliminary estimates based on information you enter and such factors as current interest rates credit score and a debt-to-income ratio.

Assuming you always pay on time your mortgage should be paid off within the agreed term. If your mortgage is uninsured then the stress test will be calculated at a qualifying rate which is the higher of. Financing it increases your loan amount and you have to pay interest on it.

OneMain charges an origination fee of 25 to 500 or 1 to 10 a late payment fee of 5 to 30 or 15 to 15 of the monthly payment or delinquent portion as well as insufficient funds fee. If your mortgage is insured then the qualifying rate is the higher of. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

Using the above calculator can help you put together all of these complex variables to get a clear picture of your monthly mortgage payment so you know exactly how much to expect. Closing costs account for a number of mortgage lender fees also known as origination charges title company fees and a number of other administrative charges that are collected by. A 15-year FRM has 180 payments spread throughout 15 years.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. The above calculator is for fixed-rate mortgages. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

This can cost around 100 to 200 sometimes up to 300. CPI Basket Category and its Contents 2011 2013 2015. Get started today and find your perfect mortgage.

Mortgage loan basics Basic concepts and legal regulation. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

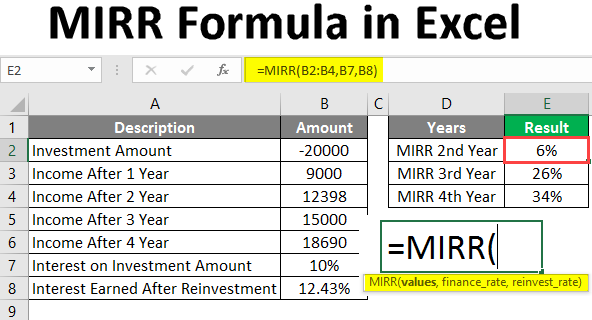

Mirr Formula In Excel How To Use Mirr Function With Examples

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Top Blank Checklist Template Pdf Cleaning Schedule Templates Cleaning Checklist Template Cleaning Schedule Printable

20 Beautiful Wooden Deck Ideas For Your Home Patio Deck Designs Building A Deck Decks Backyard

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

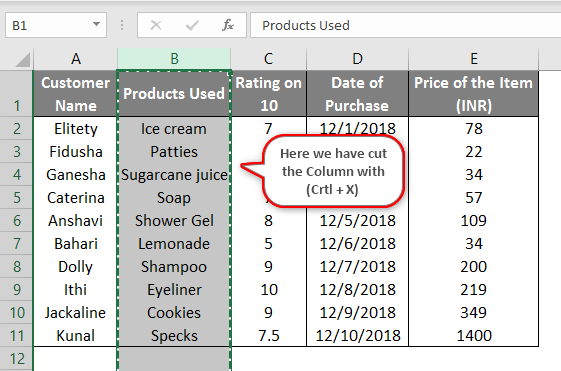

Switching Columns In Excel How To Switch Columns In Excel

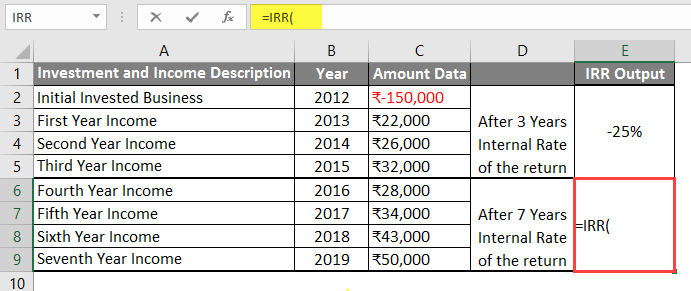

Excel Irr Formula How To Use Excel Irr Formula

7 Cancellation Letter Templates Letter Templates Free Letter Templates Letter Template Word

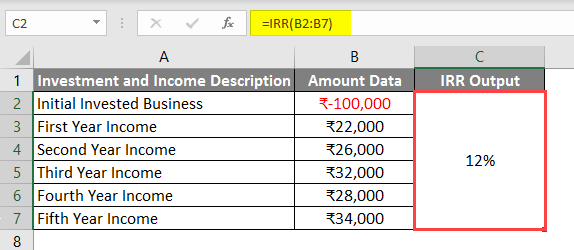

Excel Irr Formula How To Use Excel Irr Formula

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

34 Sample Budget Calculators In Pdf Ms Word

Elegant White Kitchen Design And Layout Ideas White Kitchen Design Home Decor Bright Homes

Image Result For Custom Bed Headboards Wood Bed Headboard Wood Custom Bed Simple Bed Frame

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Pin On Projects To Try

34 Sample Budget Calculators In Pdf Ms Word

34 Sample Budget Calculators In Pdf Ms Word